Stand alone accounting software has historically given accounting professionals a simple way to manage invoices and payroll locally on the office computers.

However in the last few years, cloud software for accountants options have emerged offering more advanced features. This means that stand alone accounting software systems are becoming less popular, with modern accounting firms in favour of a more innovative approach.

When it comes to dealing with vast amounts of payroll, tax information and profit and loss accounts: as an accountant, who wouldn’t want a similar, pain-free experience when dealing with clients? In this article, we’ll compare the two options, and assess how well each can fulfil the key criteria for running your accounting business smoothly.

What is stand alone accounting software

Stand alone accounting software has been serving the industry for a long time. In the past, it was common to buy your software from a physical shop, receive it as a physical product like a CD, and download this onto one device at your home or office.

While it is still possible to buy stand alone accounting practice management software, it is not the most readily available version of a product, and at the rate of which cloud computing is growing globally and needs for remote working expand; stand alone accounting systems seem slow and out-dated. Within a competitive and evolving industry, flexibility, productivity and security are just three improvements that can be made by implementing a cloud accounting software solution.

What is cloud accounting software

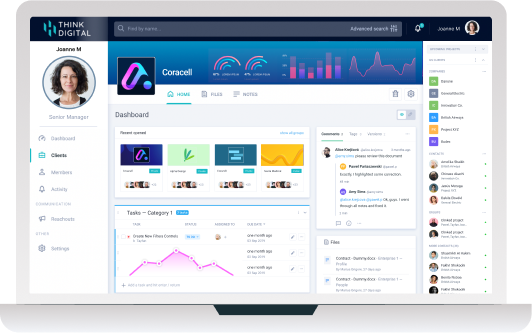

Traditional bookkeeping software is a main focus for accountants, and it is now very common to have this as well as project management and customer platform software available as a cloud based portal that can manage your tasks for you online.

Cloud software allows you to have your files accessible when you need them, and not be tied down to a single fixed desktop. How this is particularly valuable for accountants is the ability to store multiple clients' details separately and safely, and reach your client’s documents wherever you are.

When comparing both standalone accounting software and cloud based software for accountants, there are notable differences that should be taken into consideration if you're weighing up your options. Here are the main features that should be looking out for:

Stand alone accounting software vs. Cloud Accounting Software

Accessibility

Cloud accounting software provides financial professionals with fast and easy on-demand access to important documentation, as well as real-time communication for clients and team members who may be located worldwide. You can bring up client financial data, edit and approve files, and track deadlines, all from a secure and central cloud workspace.

Stand alone accounting software systems, which are hosted locally, provide less convenience as they can’t be immediately accessed from anywhere other than on in-house computers. This can make it difficult for international clients and team members to instantly retrieve files and folders.

Collaborative Interactions

The opportunity to work collaboratively with clients is greatly improved for accountants using cloud accounting software. Clients can be more involved and work in real time with their accounting processes by having access to file versions, upcoming tasks, and conversations with their accountant. As stand alone accounting software offers restricted user and location access, it can be significantly harder to collaborate with clients and team members on important files that may require multiple user editing.

Scalability

An increase in clients and storage requirements calls for the need to scale up the existing solution.

With cloud accounting software, accountants can choose to upgrade their subscription instantly – leading to immediate access to increased storage space and new accounts for clients and team members. There will be minimal hassle, and business can resume as normal, without any hold-ups. Scaling standalone accounting software can require a significant amount of effort. If new employees are hired, new licences will need to be purchased and uploaded manually. And if more storage space is needed, another server will need to be bought.

Cloud software is the more cost effective route for rapidly growing firms, where standalone accounting systems can be costly.

Security

Security should be a high priority when looking at cloud accounting software, due to the sensitive nature of the industry’s customer details. With the required storage of highly confidential documentation, such as payroll and tax information - most cloud software vendors offer a minimum of bank-grade level security and also private cloud solutions to accommodate more demanding requirements. Some companies may want complete control over their accounting data, and don’t want it accessed anywhere where they cannot directly monitor the usage; meaning that more traditional accounting systems could be more appropriate.

Having stand alone accounting software on something like a laptop that can be lost or a singular desktop which can be compromised is also risky for financial professionals when it comes to security.

It’s also worth thinking about backups: cloud software vendors continually and automatically back up data, whereas standalone accounting software needs to be backed up manually.

Cost

With cloud accounting software, the solution is usually purchased through the Internet. Generally, this will mean a monthly payment is made to the software vendor each month through a subscription. As there will be a number of solutions available, research is recommended, so that the required needs are met by the cloud software solution. For the purchase of standalone accounting systems, a large upfront cost is required for the hardware, software, servers and facilities - all of which are needed to set up the system. This is all much more expensive than a regular cloud subscription which you can cancel if it doesn't work out for you.

In conclusion, cloud-based software is the more flexible, secure and cost-effective solution for accountants. Cloud software makes it easier for accountants to analyse and report financial information to clients – from anywhere, at any time. There is an additional benefit that cloud based software can offer – increased collaboration with your clients, to exchange documents, automate approval flows, and so on. A client portal can provide you with the right tool for that. So if you are interested in cloud software for accountants, book a demo to see if Clinked is the fit for your business!

Let Us Know What You Thought about this Post.

Put your Comment Below.