M&A (mergers and acquisitions) is a term often thrown around in the business world, but what does it actually mean? In short, M&A is the process of buying or selling a company. This can be done with the help of a financial advisor, or through an online data room. If you're thinking of buying or selling a company, it's important to understand the ins and outs of M&A. This includes understanding the role of the data room in the process.

This article will explain everything you need to know about M&A data rooms, including what they are, how to structure them, and what is a data room provider. By the end, you'll be an expert on M&A data rooms!

M&A process overview

The M&A process is a long and complicated one, with many different steps involved. While each merger and acquisition is unique, there are some common elements that are typically involved in most deals.

The first step is usually identifying potential targets. This can be done through a variety of methods, such as market research, competitor analysis, or simply keeping an eye on companies that may be up for sale. Once potential targets have been identified, the next step is to approach them and begin negotiating a deal.

Due diligence is an important part of the M&A process, as it allows buyers to investigate the financial stability and overall health of the target company. This can be a lengthy process, involving reviewing financial statements, interviewing employees, and touring facilities.

Once due diligence is complete and a deal is agreed upon, the next step is to finalize the transaction. This usually involves signing a purchase agreement and completing any necessary financing. Once the transaction is complete, the new company will be formed and begin operating as one entity.

There are many different aspects to consider when undergoing an M&A transaction. However, by working with experienced professionals and being aware of the common steps involved, the process can be navigated successfully.

What is an M&A Data Room?

If you're involved in an M&A transaction, it's likely that you'll need to use a data room at some point. Here's what you need to know.

A data room is a central repository of information that is used during the due diligence process in mergers and acquisitions (M&A). It is a secure, online platform where buyers and their advisers can access key documents relating to the target company.

The use of data rooms has become increasingly commonplace in M&A transactions, as they offer a number of advantages over more traditional methods of sharing information, such as sending hard copies by courier.

Data rooms are highly secure, with strict controls on who can access them and what actions they can take. They also allow for real-time monitoring of who is viewing which documents, making it easy to identify any potential leaks.

Another key benefit of data rooms is that they facilitate a more efficient due diligence process. Buyers no longer have to wait for hard copies of documents to be sent to them; they can simply log in and start reviewing the information at their convenience.

Why Are M&A Data Rooms Essential?

A data room is essential in M&A for a number of reasons. First, it helps to level the playing field between the buyer and seller. In many cases, the seller will have more knowledge about the company being sold than the buyer. Having a central repository of information helps to even out this knowledge gap.

Second, a data room can help speed up the deal process. By having all of the relevant information in one place, buyers and their advisors can quickly review materials and move on to due diligence.

Third, a data room can help protect the seller’s confidential information. By using a secure online repository, the seller can be sure that only authorized parties will have access to sensitive documents.

The Importance of Data Protection in M&A

M&A transactions are complex and often sensitive, making data protection an important consideration. The European Union's General Data Protection Regulation ("GDPR") imposes strict requirements on the handling of personal data, and these requirements must be met in order for a transaction to proceed smoothly.

Data protection is an important issue in M&A and private equity transactions for several reasons. First, the GDPR requires that all personal data be handled in accordance with its provisions, and this can be a challenge in transactions where multiple parties are involved. Second, personal data is often one of the most valuable assets of a company, and it is important to ensure that it is properly protected. Finally, the GDPR imposes significant fines for companies that violate its provisions, and these fines can have a material impact on the value of a transaction.

How Do You Structure an M&A Data Room? (M&A Data Room Checklist)

An M&A data room is a critical part of any merger or acquisition transaction. It is a central repository for all the documentation and information that potential buyers will need to due diligence the deal.

The data room should be set up well in advance of any marketing of the business and should be managed by a neutral third party (such as an investment bank or law firm).

The contents of an private equity data room will vary depending on the type and size of the transaction, but typically will include:

- Financial information: This is perhaps the most important type of information that should be included in the data room. Financial statements, tax returns, and other financial documents will give potential buyers a clear picture of the financial health of the company.

- Operational information: This is based on customer lists, supplier contracts, employee handbooks, and any other information that will help potential buyers understand how the company operates on a day-to-day basis.

- Legal information: All relevant legal documents should be included in the data room. This includes things like incorporation documents, shareholder agreements, and intellectual property filings.

- Commercial information: This type of information is important for understanding the company's position in the marketplace. Things like market research reports, competitive analysis, and sales figures will help potential buyers understand the company's place in the market.

- Health and safety protocols: This is information on the company's health and safety procedures and policies.

- Employee information: This includes contact information for all employees, as well as job titles and descriptions.

- Tax information: Tax returns and other tax-related documents will give potential buyers a clear picture of the company's tax liability. This is important information to have when considering an acquisition.

- Human resources information: This is based on employee job descriptions, benefit plans, and payroll records. This type of information is important for understanding the company's workforce.

- Information technology information: This includes things like the company's IT infrastructure, software licenses, and website domain names. This type of information is important for understanding the company's technology needs.

- Marketing information: This features marketing plans, advertising campaigns, and public relations materials. This type of information is important for understanding the company's marketing strategy.

The above list is by no means exhaustive, but it should give you a good idea of the types of information that should be included in an M&A data room. When in doubt, err on the side of inclusion. The more information potential buyers have, the better they will be able to assess the company and make an informed decision about whether or not to proceed with the acquisition.

Is Sharepoint a Data Room?

SharePoint is a data room? This is a common question we get asked, and it’s one that confuses a lot of people. So let’s clear things up.

SharePoint is not a data room. A data room is a physical space where companies keep their sensitive information, such as financial records or confidential legal documents. In contrast, SharePoint is a software application that helps organizations share and manage information.

So why do people often confuse the two?

Well, it probably has to do with the fact that SharePoint offers some features that are similar to those of a data room. For example, both SharePoint and data rooms allow users to upload and share files. However, there are some key differences between the two.

For one, data rooms are much more secure than SharePoint. Data rooms typically have physical security measures in place, such as locked doors and security guards, to ensure that only authorized personnel can access the information inside. They also have strict controls on who can see and edit files. In contrast, anyone with a SharePoint account can view and edit files stored in SharePoint, unless those files are specifically restricted.

Another key difference is that data rooms are designed for use by a limited number of people, usually those who need to access the information for business purposes. In contrast, SharePoint is designed for use by everyone in an organization.

Is DropBox a data room?

Yes, Dropbox can be used as a data room. In order to use Dropbox as a data room, you would need to create a folder and then invite the appropriate people to that folder who you want to have access to the sensitive files.

There are a few things to keep in mind if you're using Dropbox as a data room.

First of all, you'll want to make sure that you're using the business version of Dropbox so that you have more storage space and security features.

You'll also want to make sure that you have a good backup system in place in case anything happens to the files on Dropbox.

Finally, you'll want to be aware of the fact that anyone with access to the data room can download, edit, and share the files, so it's important to keep track of who has access to the data room and what they're doing with the files.

If you're looking for a secure way to store and share sensitive files, then using Dropbox as a data room can be a good option. Just make sure that you take the necessary precautions to ensure that your data is safe and secure.

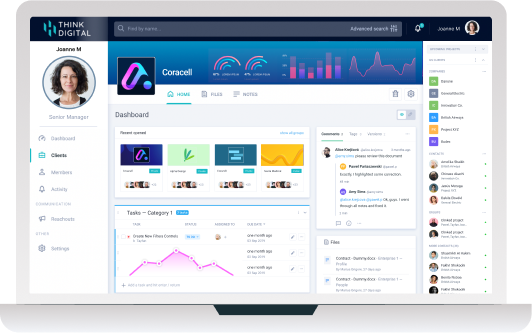

Clinked is a Data Room

Clinked is a data room software solution (also known as a Virtual Data Room or VDR) that enables organizations to securely store and share sensitive information. It is used by businesses of all sizes, from small startups to large enterprises, and is particularly popular in industries such as banking, law and accountancy. Clinked offers a number of features that make it an attractive option for businesses looking for a data room solution, including:

Clinked is a data room software solution (also known as a Virtual Data Room or VDR) that enables organizations to securely store and share sensitive information. It is used by businesses of all sizes, from small startups to large enterprises, and is particularly popular in industries such as banking, law and accountancy. Clinked offers a number of features that make it an attractive option for businesses looking for a data room solution, including:

- Security: Clinked uses 256-bit encryption to protect data stored on its platform. This makes it virtually impossible for anyone other than authorized users to access the data.

- Ease of use: Clinked is easy to set up and use, with a user-friendly interface that makes it simple to upload, share and manage files.

- Flexibility: Clinked offers a range of pricing plans to suit different budgets and requirements. It also has a number of features that can be added on, such as document signing and video conferencing.

- Customer support: Clinked provides customer support via email and through their extensive library 0f resources on their website.

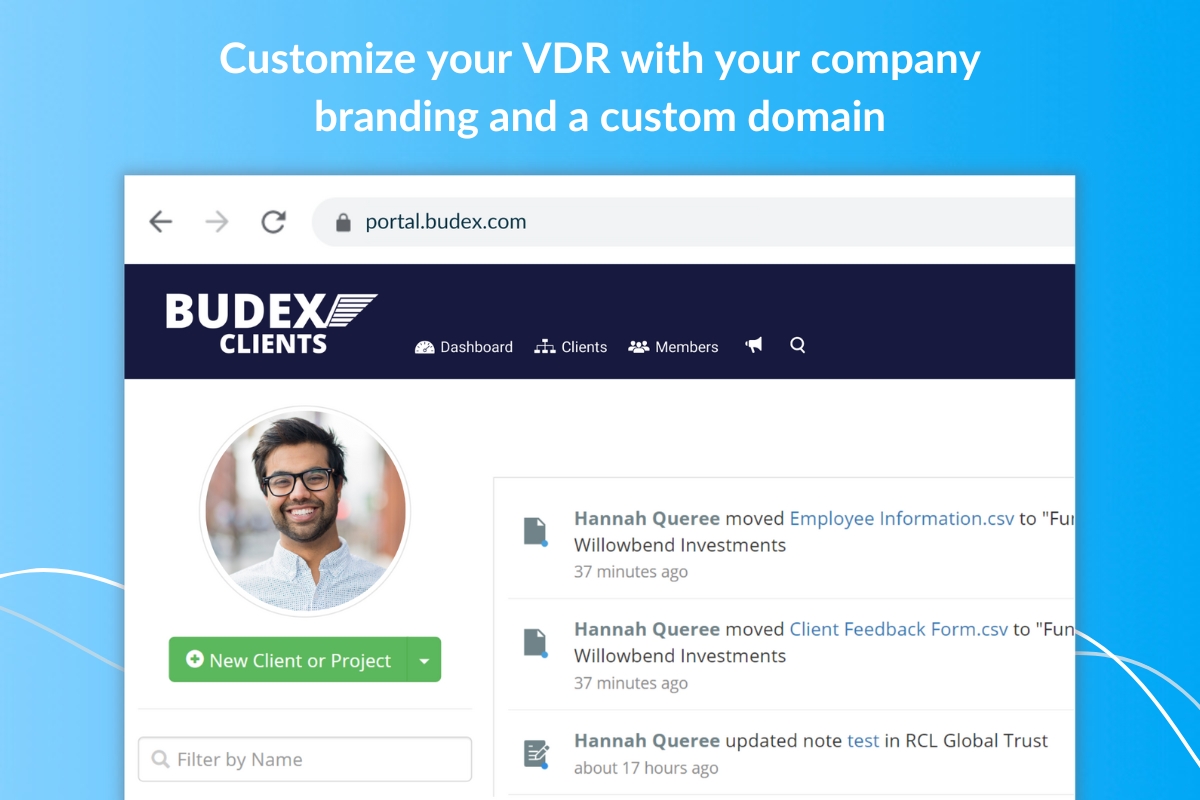

- White label: Fully brand your virtual data room with your company colours, logo, URL & more. Put your brand front and center with a 100% white label interface.

What is a Due Diligence Data Room?

A due diligence data room is an online repository of information that is used to provide transparency during the due diligence process. The data room allows all stakeholders to have access to the same information at the same time, which helps to streamline the decision-making process.

A typical due diligence data room will contain financial information, legal documents, and any other relevant information that would be used to make a decision about a potential investment. Due diligence data rooms are often used in mergers and acquisitions, but they can also be used in other situations where multiple parties need to access shared information.

The use of a due diligence data room can help to reduce the risk of making a bad investment, as all stakeholders will have a chance to review all of the relevant information before making a decision. Additionally, the use of a data room can help to speed up the due diligence process, as all of the information is readily available in one place.

How Do You Structure a Due Diligence Data Room?

There are a few things that you need to keep in mind when setting up your data room. First, you need to make sure that all of the information is organized in an easily accessible manner. This means that you should have folders for each category of information and sub-folders for each type of document. You also need to make sure that the data room is secure and confidential. This means that you should only allow access to people who need it and you should have a way to track who has accessed the data.

Once you have the virtual deal room set up, you can begin to collect the information that you need. This includes financial statements, legal documents, and any other information that will help you make an informed decision about the business, the due diligence data room checklist is very similar to the above M&A checklist. You should also take the time to speak with the current owners of the business and get their input on the due diligence process. This will help you understand what they think is important and what they believe is not important.

After you have collected all of the information, you need to analyze it in order to determine if the business is a good investment. This includes looking at the financial statements and determining if the business is profitable. You also need to look at the legal documents to make sure that there are no problems with the business. If you find any red flags, you may want to consider another business.

What is a Clean Room?

A clean room data room is a type of data room that is used during due diligence to give access to potential investors while protecting the company's confidential information. A clean room data room is completely secure and only allows authorized users to access the information inside. This type of data room is typically used during mergers and acquisitions, or when a company is looking for new financing.

What is a Black Box Room?

A black box room is an area within a due diligence data room where only certain information is made available. This information is typically financial in nature, and can be used to help assess the overall financial health of a company. The black box room may also contain other sensitive information, such as legal documents or trade secrets.

The term "black box" refers to the fact that this information is not generally available to the public. Only those with authorized access can view the contents of the black box room. This access is typically granted on a need-to-know basis.

The black box room is typically one of the last areas to be opened during the due diligence process. This is because the information contained within it can be highly sensitive and may be used to negotiate the final purchase price of a company. For this reason, it is important that only those with a legitimate need for this information have access to it.

What is a Data Room Provider?

A data room provider is a company that specializes in providing secure data rooms for companies to use during sensitive business transactions, such as mergers and acquisitions (M&A), initial public offerings (IPOs), and other types of fundraising.

Clinked is an example of a data room provider, and their website notes that they offer a " A Secure & Intuitive Space For Your Teams & Clients".

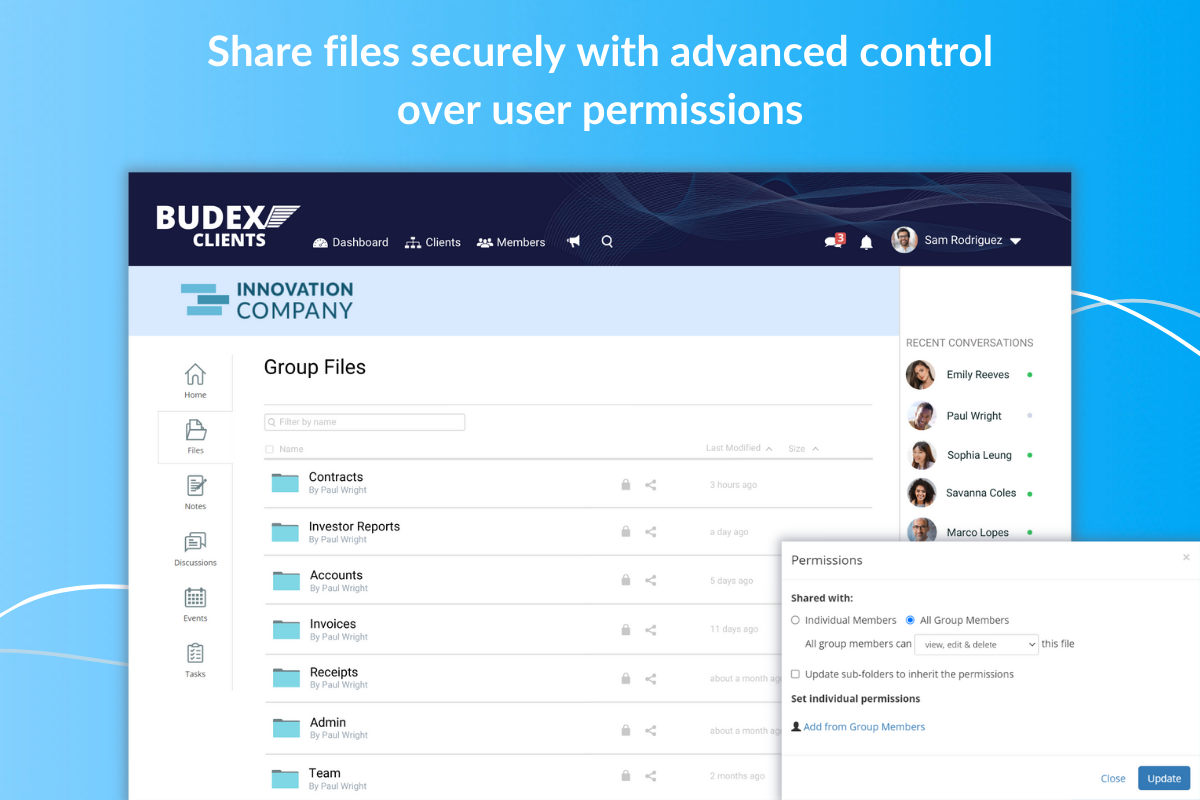

Data room providers typically offer features such as watermarking, activity logs, and user permissions to help companies keep track of who is accessing which documents, and when. They also often have features to allow for secure file sharing and collaboration between parties involved in a transaction.

So there you have it, an overview of the M&A process and some of the key components to consider when setting up your data room. We’ve looked at what a data room is, why it’s essential in any M&A transaction and how to structure one for your business. But we know there are still lots of questions out there so please let us know in the comments below and we will do our best to answer them. In addition, if you need help setting up your data room or want advice on which provider to choose, our team at Clinked would be happy to assist.

Let Us Know What You Thought about this Post.

Put your Comment Below.